Download this page as a PDF document.

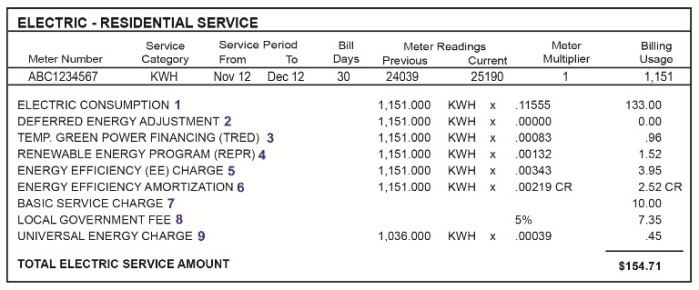

Below is a section of a sample residential NV Energy bill for a typical Southern Nevada customer. This sample shows nine line item charges that add together to equal the customer's total bill due, which in this case is $154.71. Hover over and click on the nine line items listed below to learn about the rates and charges that make up each item, how those rates/charges originated and how often they change.

1. ELECTRIC CONSUMPTION

Revenue generated by this line item is used by the utility to cover the costs of providing its service to customers and to earn a profit on the investment made by the company and its shareholders. The Electric Consumption charge is made up of the Base Tariff General Rate and Base Tariff Energy Rate.

- Base Tariff General Rate (BTGR): This rate is set by reviewing all the utility's revenues, expenses, investments, and costs of capital to determine the amount of revenue the utility requires to cover costs, including a fair return for investors. The BTGR is a backward-looking rate, meaning it’s calculated by reviewing actual costs for a previous test year, not by projecting what the utility may need to operate in the future.

- Origin: In 1975, the Nevada Legislature created the BTGR through the passage of Assembly Bill (A.B.) 707. Prior to 1975, there was no distinction for general rates or any of the types of rates listed below.

- Frequency of Change: The Nevada Legislature requires regulated electric utilities to file a general rate case (GRC) application with the PUCN in June every 36 months (3 years). Any change in rates approved by the PUCN will take effect on Jan. 1 of the following year.

- More Information: Download the PUCN's General Rate Case Process Fact Sheet (PDF).

- Base Tariff Energy Rate (BTER): An electric utility generally produces electricity for its customers two ways: (1) by burning fuel (usually coal or natural gas) at its power plants to generate electricity, and (2) by purchasing electricity (referred to as purchased power) from other electric companies to resell to its customers. The BTER reimburses the utility on a dollar-for-dollar basis for fuel and electricity purchased by the utility on behalf of its customers. Utilities cannot, under Nevada law, profit from fuel and purchased power costs. The BTER is calculated by taking the actual fuel and purchased power costs for a recent 12-month period and dividing that number by sales for the same 12-month period. Because of fluctuating costs of fuel and purchased power, it's possible that too much or too little revenue is collected from ratepayers to reimburse the utility on a dollar-for-dollar basis. See the Deferred Energy Adjustment line item below to learn what happens in those cases.

- Origin: in 1975, the Nevada Legislature created the BTER through the passage of A.B. 707.

- Frequency of Change: Pursuant to NRS 704.110(10), an electric utility must adjust its BTER on a quarterly basis. (See Deferred Energy Adjustment below for more information.)

- More Information: Download the PUCN's Fuel & Purchased Power Fact Sheet (PDF).

Back to top

2. DEFERRED ENERGY ADJUSTMENT (DEA)

This rate is the difference between the money the electric utility collected for fuel and purchased power costs and the actual costs for the fuel and purchased power. If more revenue was collected through the BTER than was required to reimburse the utility on a dollar-for-dollar basis, this rate will show as a credit on electric bills. If less money was collected to reimburse the utility on a dollar-for-dollar basis, this rate will show as a charge on electric bills. In the sample bill above, the line item shows that $0 was charged or credited to the customer, which may change to a credit or charge with the rate’s quarterly adjustments.

- Origin: In 1975, the Nevada Legislature created the DEAA through the passage of A.B. 707.

- Frequency of Change: In addition to quarterly adjustments, electric utilities must also file an annual Deferred Energy Accounting Adjustment (DEAA) application to allow the PUCN to review the reasonableness and prudence of the utility's fuel and purchased power costs. Pursuant to NRS 704.187, annual DEAA applications must be filed in March and any change in the rate becomes effective 210 days later on Oct. 1.

- More Information: Download the PUCN's Fuel & Purchased Power Fact Sheet (PDF).

Back to top

3. TEMP. GREEN POWER FINANCING (TRED)

TRED stands for Temporary Renewable Energy Development. In the 2005 legislative session, the Legislature established this trust to assure payment for the costs of renewable energy to developers who had approved contracts to sell electricity to NV Energy, but who were having trouble getting financing to build their renewable energy generating plants at the time the TRED was established in 2005. The TRED rate is the payment for these contracts. Nevada Solar One is the only renewable generating plant that is paid through the TRED trust and the TRED has been closed to any additional applicants. NAC 704.8898 describes how the TRED rate is calculated.

- Origin: In 2005, the Nevada Legislature created the TRED through the passage of A.B. 3 (Section 23) during the 22nd Special Session.

- Frequency of Change: The TRED is changed once a year in the electric utility's annual DEAA application (see Deferred Energy Adjustment above).

- More Information: See NRS 704.7827 and NAC 704.8894 - NAC 704.8899.

Back to top

4. RENEWABLE ENERGY PROGRAM (REPR)

In the sample bill above, the customer is charged $1.52 to fund the renewable energy programs listed below.

- Solar Energy Systems Incentive Program (SESIP): This is a rebate program for electric utility customers who install solar photovoltaic (PV) systems. NAC 701B.140 explains how the SESIP rate is calculated.

- Wind Energy Systems Demonstration Program (WIND): The Nevada Legislature established this rate to provide a rebate program for electric utility customers who install wind energy systems. NAC 701B.495 explains how the WIND rate is calculated.

- Waterpower Energy Systems Demonstration Program (WATERPOWER): The Nevada Legislature established the WATERPOWER rate to provide a rebate program for electric utility agricultural customers who install waterpower energy systems. NAC 701B.675 explains how the WATERPOWER rate is calculated.

- Origin: In 2007, the Nevada Legislature created the WATERPOWER rate through the passage of S.B. 437. In 2011, the Nevada Legislature passed A.B. 380 to extend the life of the WATERPOWER rate to Dec. 31, 2021.

- Frequency of Change: The WATERPOWER rate is changed once a year in the utility's annual DEAA (see Deferred Energy Adjustment above) application.

- More Information: See NAC 701B - Renewable Energy Programs and NRS 701B - Renewable Energy Programs.

Back to top

5. ENERGY EFFICIENCY (EE) CHARGE

The Energy Efficiency Charge line item combines the rates listed below.

- Energy Efficiency Program Rate (EEPR): The Nevada Legislature established the EEPR to allow electric utilities to recover the program costs of energy efficiency and conservation programs, such as refrigerator recycling, pool pump and heating rebates, and discounts for LED light bulbs. Program costs include labor, overhead, materials, incentives paid to customers, advertising, marketing, monitoring and evaluation. See NAC 704.9523 for information on how the EEPR is calculated. It's possible that too much or too little revenue is collected from ratepayers to reimburse the utility for program costs. See the Energy Efficiency Amortization line item below to learn what happens in those cases.

- Origin: In 2009, the Nevada Legislature created the EEPR through the passage of S.B. 358.

- Frequency of Change: The EEPR changes once a year in the utility's annual DEAA application (see Deferred Energy Adjustment above), based upon budgets prepared by the electric utilities and approved by the PUCN in a triennial budget filing.

- More Information: See NAC 704.9523.

- Energy Efficiency Implementation Rate (EEIR): The Nevada Legislature established the EEIR to allow electric utilities to recover the measurable and verifiable effects of the utilities' energy efficiency and conservation programs, known as "lost revenues." In other words, the EEIR reimburses the utility for revenue lost because customers purchase energy efficient appliances (refrigerators, pool pumps, light bulbs, etc.) and, therefore, use less energy. It's possible that too much or too little revenue is collected from ratepayers to reimburse the utility for lost revenues. See the Energy Efficiency Amortization line item below to learn what happens in those cases.

- Origin: In 2009, the Nevada Legislature created the EEIR through the passage of S.B. 358.

- Frequency of Change: The EEIR changes once a year in the utility's annual DEAA application (see Deferred Energy Adjustment above), based upon budgets prepared by the electric utilities and the measured and verified effects of energy efficiency and conservation programs as filed for approval by the PUCN.

- More Information: See NAC 704.9524, which also explains how the rate is calculated.

Back to top

6. ENERGY EFFICIENCY AMORTIZATION

This rate recovers or refunds the difference between the collected EEPR and EEIR revenues and recorded program costs and lost revenues. In the above sample bill, the customer is refunded $2.52 because the PUCN found the utility over-collected through the EEPR and EEIR. This line item would show as a charge if the EEPR and EEIR were found to have been under-collected.

- Origin: The Amortization EEPR and Amortization EEIR were defined in the PUCN's rulemaking to implement the requirements of S.B. 358. They are the balancing mechanism to adjust for the over- or under-collection of the EEPR and EEIR rates.

- Frequency of Change: The EEIR changes once a year in the utility's annual DEAA application (see Deferred Energy Adjustment above).

- More Information: See NAC 704.9524 and NAC 704.9523.

Back to top

7. BASIC SERVICE CHARGE

The Basic Monthly Service Charge is a flat fee that reimburses the utility for its investment in meters, power lines, and other distribution facilities not recovered in other charges, as well as customer related expenses that do not vary with electric use. All residential customers pay the same amount each month, which is $10 in the above sample bill, regardless of how much electricity the customer uses because the cost is fixed and does not vary based on usage. (Non-residential customers pay a higher basic service charge than residential customers.)

- Origin: The Nevada Legislature established the Basic Monthly Service Charge through passage of A.B. 707 in 1975.

- Frequency of Change: The Nevada Legislature requires electric utilities to file a GRC application at least once every three years. (NRS 704.110(3)) The basic monthly service charge is subject to change based on the utility's GRC filing.

- More Information: Download the PUCN's General Rate Case Process Fact Sheet (PDF).

Back to top

8. LOCAL GOVERNMENT FEE

This line item consists of fees imposed by local governments, including business license taxes, franchise fees, and right-of-way fees. In 1995, the Nevada Legislature passed S.B. 568 to establish a 5% cap on the fees that a local government can impose on the gross revenues of public utilities that are derived from customers located in the local government's jurisdiction. In Southern Nevada, all of the local governments (Clark County, Henderson, Las Vegas and North Las Vegas) have imposed the maximum 5% fee. These fees are not kept by the utilities but are passed through to the local governments.

Back to top

9. UNIVERSAL ENERGY CHARGE

The Universal Energy Charge (UEC) funds energy assistance and conservation programs for low-income electric consumers. Seventy-five percent of the fund is distributed to the Nevada Division of Welfare and Support Services to assist low-income households pay their electric and natural gas bills. Twenty-five percent of the fund is distributed to the Nevada Housing Division to assist low-income households implement energy conservation, energy efficiency and weatherization strategies.

- Origin: In 2001, the Nevada Legislature established the UEC through the passage of A.B. 661 (Sections 26.05 to 26.95).

- Frequency of Change: Pursuant to NRS 702.160, a UEC of 0.39 mills (a mill is one-tenth of a cent) per kWh is collected on electric bills. The charge of 0.39 mills per kWh has not changed since the Nevada Legislature established the UEC in 2001.

- More Information: Review NRS 702.160 and the websites for the Division of Welfare and Support Services and the Nevada Housing Division.

Back to top